Personal Injury: How to Protect Yourself from Fraud and Negligence in the Digital Era

The internet and social media have made filing personal injury claims easier than ever. Unfortunately, this also means more opportunities for fraud and negligence. As a claimant, you need to be vigilant to avoid scams and ensure you receive fair compensation with the guidance of a personal injury lawyer.

This article provides tips to protect yourself when seeking damages for an injury in the digital age.

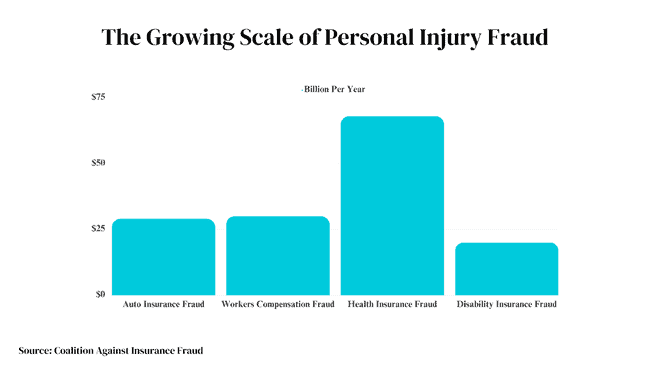

The Rise of Personal Injury Fraud in the Digital Age

In 2020 alone, over 791,790 complaints related to digital fraud were reported to the FBI’s Internet Crime Complaint Center (IC3), with losses exceeding $4.2 billion. The landscape of personal injury fraud is rapidly evolving with perpetrators finding creative new ways to stage accidents and make false claims in the digital age.

Information is now easily accessible online, which allows fraudsters to learn how to file claims quickly. They can also use technology to edit photos and manufacture evidence. This makes it harder than before to detect fraudulent claims. With digitally savvy fraudsters trying new tactics, it’s important to have an experienced Virginia Beach personal injury attorney on your side who can identify doctored evidence and build a strong case if you suffer a legitimate injury.

Emerging Digital Fraud Trends

As personal injury claims move online, so do the tactics of scammers seeking to take advantage of victims. Some emerging digital fraud trends to look out for include:

-

Social media imposters:

Fraudsters create fake profiles mimicking real law firms, insurance companies, or representatives to interact with potential targets. Always verify who you are dealing with via phone or the official website.

-

AI-generated content:

Beware legal sites or advisors utilizing artificially intelligent writing tools to create fake reviews, website copy, medical reports, and other documents that appear authentic. Be skeptical of generic or odd-sounding language.

-

Deepfakes:

These doctored videos and audio recordings, created via AI, portray events or speech that never occurred. Injurers or insurers could potentially use deepfakes to distort witness statements or surveillance evidence. Scrutinize anything that looks or sounds dubious.

-

Hacking and malware:

Phishing ploys or malware target claimants to steal their personal data for identity theft. Never click suspicious links, download unfamiliar programs to your devices, or give sensitive info if you cannot confirm the legitimacy of the request.

As technology evolves, so do the tactics for deceiving injury victims online. Stay a step ahead by being aware of emerging digital fraud methods and verifying everything related to your claim.

Perform Due Diligence on Attorneys

One common fraud tactic is for scammers to pose as lawyers seeking to represent you. They may reach out via email, social media ads, or phone calls promising guaranteed payouts. Before hiring an attorney:

- Verify their bar license through your state bar association website.

- Research online reviews and complaints. Beware of fake reviews.

- Ask detailed questions about their qualifications and strategy for your case.

- Avoid attorneys who contact you first or guarantee specific settlements.

Research Insurance Companies

Dishonest insurers may try to lowball or deny legitimate claims. Research the company’s reputation and complaint record before filing. Consult online reviews and the Better Business Bureau. Also, check your state Department of Insurance website for disciplinary actions against the company.

Scrutinize Settlement Offers

Fraudsters often pressure claimants to accept unreasonably low settlements before conducting full investigations. Don’t let anyone rush you into signing. Consult with your attorney to determine fair compensation. Require all settlement offers in writing from insurers.

Beware of Identity Theft

Your personal information is gold for fraudsters. Never share sensitive data like Social Security numbers or driver’s license info online or over the phone until you verify who you are dealing with. Also, beware of phishing emails seeking such data.

Use Caution on Social Media

Posting details about your injury online can hurt your case. Insurance investigators search sites like Facebook for evidence of fraud. Avoid posting about your accident until your claim is resolved. Temporarily make accounts private.

Review All Paperwork Thoroughly

Carefully read any documents before signing. Make sure information like dates, locations, and settlement amounts are accurate. Never sign blank releases or other unfinished paperwork. Ask your attorney to explain anything unclear.

How Insurers Detect Fraudulent Claims

Insurers have sophisticated digital tools to identify suspicious patterns:

-

Social media monitoring:

They search profiles for discrepancies about injuries or lifestyles.

-

Geolocation data:

Cell phone records and metadata can reveal claimant locations inconsistent with their story.

-

Medical audits:

Billings get cross-checked against treatment records to spot inflated charges.

-

Video surveillance:

Claimants may get secretly recorded performing activities they claim they cannot do.

How Scammers Find Victims Online

The internet provides a goldmine of tools for fraudsters seeking personal injury victims. Some sneaky tactics they use:

- Searching public court records for recent accident lawsuits, then cold contacting those plaintiffs soliciting legal or financial services.

- Buying online ads with misleading phrases like “injured in an accident? click here!” which direct targets to persuasive landing pages full of attorney offers.

- Scouring forums, social media groups, and Craigslist for posts by people discussing recent injuries or asking for attorney recommendations.

- Creating official-looking websites offering “accident injury grants” or other too-good-to-be-true financial assistance.

- Sending bulk emails or social media messages to purchased lists of addresses in a certain city or demographic.

Stay skeptical of unsolicited contacts offering legal help or money. Do your research before responding or sharing personal information that could enable identity theft.

Tips to Avoid Looking Fraudulent

You can avoid behaviors that raise red flags:

- Don’t exaggerate the facts about your case online or to doctors.

- Don’t post photos or check-ins from locations that contradict your story.

- Make sure your treatment history matches the medical records.

- Avoid requesting unnecessary treatment or medications.

- Notify your attorney about any other circumstances that may impact your claim, like pre-existing conditions.

What to Do If You Suspect Fraud

If you believe someone is unlawfully interfering with your claim:

- Document everything – Keep detailed records of all correspondence, calls, and events.

- Hire a reputable attorney – They can request records, negotiate with insurers, and take legal action if needed.

- Report concerns to your state authorities – Insurance departments and attorney general offices investigate fraud.

With vigilance and caution, you can avoid scams and get proper compensation for your personal injury. Protect yourself without fear by following the tips above.

FAQs

Q: What are some common signs of a personal injury scam?

A: Indicators to be alert to encompass pushy sales tactics, enticing promises of fast cash, demands for upfront fees, hesitance in responding to inquiries, fabricated reviews, absence of valid licenses and credentials, high-pressure tactics for swift document signing, and appeals for sensitive personal data.

Q: Can I file a personal injury claim without an attorney?

A: You can, but having a qualified attorney makes the process much easier and helps maximize your compensation. They know how to effectively negotiate with insurance companies and navigate the legal system.

Q: What should I do if an insurer denies my claim?

A: First, get a written reason for the denial. Review it for errors or unfair reasoning, and discuss concerns with your attorney. They can advise on the next steps like appealing internally, requesting arbitration, or filing a lawsuit against the insurer.

Q: Can insurers investigate my social media accounts?

A: Yes, it’s common for insurers to monitor claimants’ public social media profiles for evidence that contradicts alleged injuries. Make accounts private and avoid posting details about your accident until resolved.

Q: How can I check whether a lawyer is licensed in my state?

A: Every state has an official bar association website where you can verify an attorney’s license status for free. This resource lets you confirm credentials and spot red flags.

Conclusion

With the right protections, you can avoid fraudsters and seek fair damages if you are the victim of negligence. Stay vigilant and know your rights during the claims process. With each passing year, new digital tools emerge to better detect scams – but also protect legitimate claimants.

For a closer look at the insights discussed, be sure to check out the full article. Happy exploring!